Raise the topic of monopolies, and the ensuing discussion will quickly highlight ideological blind-spots.

A colleague with whom I’ve taught courses in business and capitalism sent to me, enthusiastically, this article by Paul Krugman,  a Nobel-Prize-winning economist. Krugman attacks Amazon and calls for it to be cut down a few notches. Amazon, he says, has too much power and is abusing its power. Raising the specter of the “robber baron” era, the Nobel-Prize-winning economist invokes the precedent of Standard Oil’s being broken up by the government’s antitrust warriors of the time.

a Nobel-Prize-winning economist. Krugman attacks Amazon and calls for it to be cut down a few notches. Amazon, he says, has too much power and is abusing its power. Raising the specter of the “robber baron” era, the Nobel-Prize-winning economist invokes the precedent of Standard Oil’s being broken up by the government’s antitrust warriors of the time.

There certainly are parallels between Amazon and Standard — though not the ones Krugman has in mind — but his pattern of thinking about how markets work is common to many casual and professional economists, so his reasoning worth a closer look.

Here is why we are supposed to be afraid of monopolies: a business with a monopoly might use its power to gouge customers. But if the business faced competition, it couldn’t charge such high prices. So, the argument concludes, in the interests of protecting consumers, the government should step in and regulate the business’s abusive practices.

What abuses is Amazon supposed to have committed? It’s hard to pin Krugman down here. He grants that Amazon does not dominate book sales, so it’s not really a monopoly. Also, he acknowledges that it has not raised prices, so it’s not hurting customers. Instead the opposite is true: Amazon has made access to books access easier and it lowered prices. Krugman counts himself a satisfied customer among millions of satisfied customers. (We could add that Amazon has yet to make a profit.)

But he still wants to attack it.

Krugman’s complaint is not that Amazon will raise prices and harm its consumers but that it is making things harder for its competitors. Amazon’s market share gives it leverage in its negotiations with other book suppliers and sellers, and it uses that leverage to get the most advantageous terms it can. It is a monopsony, Krugman accuses — though again not really, since those suppliers have many outlets other than Amazon available to them and are free to develop new ones.

So how strong is the case for cutting Amazon down to a Krugman-approved size?

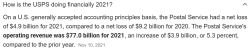

Here is my test question for gauging the seriousness of anyone’s concern with monopoly: What do you think of the US Postal Service? Are you angry about it? Are you using your voice to call for its abolishment?

Are you angry about it? Are you using your voice to call for its abolishment?

Because the USPS is a real monopoly. It has a 100% market share for first-class mail. Its monopoly was not earned in the free market. Instead, it is a government-granted and government-enforced monopoly. Competition is not allowed — by force. Try to start a business in competition with the USPS: the police will come; you will be put out of business; and you may go to prison.

By contrast, Amazon earned its market share, as all of its customers chose it over other options, and Amazon cannot call upon the police to force its competitors out of business.

Also, the USPS has many government-granted special privileges. It is exempt from income taxes. Its vehicles cannot be given parking tickets. When it loses money, as it does regularly to the tune of billions of dollars, it is bailed out by taxpayers. Imagine if FedEx or UPS had or even lobbied for any of those privileges.

But maybe we are being naïve about Amazon’s long-range strategy. Maybe Amazon is conspiring first to drive its competitors out of business so that it can then stick it to its customers. Maybe.

Therefore, in judging who is really serious about monopolies, contrast reactions to the USPS and Amazon:

* The USPS has a 100% monopoly on first-class mail; Amazon has a large share of its market.

* The USPS’s position was granted by government; Amazon earned its position in the free market.

* The USPS has any would-be competitors put out of business by force; Amazon’s competitors are free to enter and stay in the market.

* The USPS has a long list of government-granted operational privileges; Amazon has none of them.

* The USPS has an actual track record of sticking taxpayers with its losses; Amazon might at some future time raise prices to consumers.

My view is that Amazon should be celebrated and that it should grow — and that the USPS is a moral and political abomination that should be abolished. Meanwhile, Professor Krugman is happy with the USPS (he carries water for it here) — and wants a diminished Amazon. Perhaps we are both just pointy-headed academics with opposite blind-spots.

Or perhaps we can legitimately ask a serious question for the so-called anti-monopolists: Why haven’t they gone after the USPS?

The answer is ideological: But it’s the government! Government-created monopolies get a pass, but successful private businesses get the cold stare of suspicion.

The antitrust warriors have standard complaints whatever a large, successful business does. If it raise prices, they can charge is that it is gouging customers! If it lowers prices, it’s engaging in cut-throat competition! And if it charges the same prices as its competitors, guess what? Price-fixing!

Note the pattern of debate about successful businesses in history. Standard Oil was attacked early in the twentieth century — even though it had increased the quantity of oil products available, improved their quality, and lowered prices dramatically through its entire history. So it was with Alcoa and aluminum in the middle of the twentieth century. So it was with Microsoft and software at the end of the century. And now in the twenty-first the same pattern might be followed with Amazon and books.

Often contemporary debates about monopoly make reference to the now-discredited “robber baron” thesis of business history. There were robber barons, but they were almost always businessmen in partnership with governments, leading to all of the usual corruptions and unintended consequences.  As a corrective and an introduction to a better generation of business history, I recommend Professor Burton Folsom’s The Myth of the Robber Barons for six case studies of American business titans — J. D. Rockefeller, the Scrantons, Cornelius Vanderbilt, Charles Schwab, Andrew Mellon, and J. J. Hill — who were often called “robber barons” but were instead free-market operators who succeeded by innovation, making quality and quantity improvements, and lowering prices.

As a corrective and an introduction to a better generation of business history, I recommend Professor Burton Folsom’s The Myth of the Robber Barons for six case studies of American business titans — J. D. Rockefeller, the Scrantons, Cornelius Vanderbilt, Charles Schwab, Andrew Mellon, and J. J. Hill — who were often called “robber barons” but were instead free-market operators who succeeded by innovation, making quality and quantity improvements, and lowering prices.

Meanwhile the many government-created monopolies in finance, liquor sales, education, utilities, and so on, continue without significant challenge.

There are important economic and business-historical arguments about monopolies to be made. But for now the important point is that many of the attacks on “monopolies” are not about monopolies. Those making the loudest noises are often perfectly happy with monopolies — as long as they are administered by government.

The key, principled issue is whether we think free individuals can manage their business affairs, individually and cooperatively — or whether we want a small group of individuals who share a certain ideology to manage the business world for us.

[This article was originally published in English at EveryJoe.com and translated into Portuguese.]