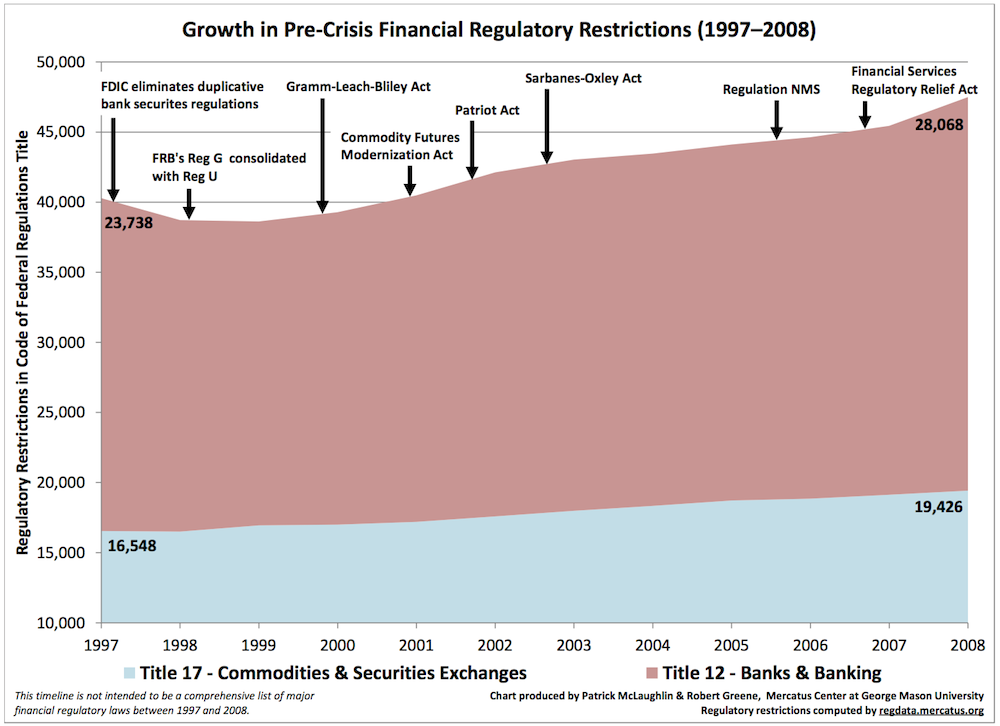

In my “Where are all those free-market economists who caused the financial crisis?”, I cited survey results showing that very few professional economists are deregulation advocates, and I cited data indicating an increase in regulation in the lead-up to the crisis.

Here is Regdata’s more recent “Did Deregulation Cause the Financial Crisis? Examining a Common Justification for Dodd-Frank,” which reports more precise, updated data:

“we find that between 1997 and 2008 the number of financial regulatory restrictions in the Code of Federal Regulations (CFR) rose from approximately 40,286 restrictions to 47,494—an increase of 17.9 percent.”

Further:

“Regulatory restrictions in Title 12 of the CFR—which regulates banking—increased 18.2 percent while the number of restrictions in Title 17—which regulates commodity futures and securities markets—increased 17.4 percent.”

Related:

My collected posts on The Financial Crisis.

Several scholars have argued that a lack of transparency about banks’ risk exposures prevented markets from correctly pricing risk before the crisis, enabled the mortgage market to grow larger than it otherwise would have, and made the financial crisis far more disruptive than it would have been if risk levels had been disclosed in a straightforward, readily understandable format.